❄️The Bulletin #29: Crypto winter, How the SVB crash could have gone worse, and Montana's TikTok ban

In this week's bulletin- The steep decline in VC funding in crypto, new research into the SVB crash, and a look into Montana's plan to ban TikTok. Also, one more week to Startup Connect!

Happy spring everyone! This week’s newsletter comes from under a tree in Ruth Simmons Quad, as I try to enjoy as much of this beautiful warm weather while its here☀️. I hope the weather makes you as cheery as it makes me, happy reading!

💰Crypto VC funding plunges 80%

According to PitchBook data, private funding for crypto startups in the first quarter of this year plunged to its lowest level since 2020, with global VC funding for the industry falling to $2.4 billion, an 80% decline from its all-time high of $12.3 billion during the same period last year.

This decline was due to a variety of factors, including regulatory uncertainty, market downturn, and scandals. Nevertheless, despite the challenges, there is still some interest among VCs in backing crypto infrastructure startups, data analytics firms, and developer platforms.

For instance, M^Zero Labs, a decentralized finance infrastructure startup based in Berlin, managed to raise $22.5 million in a funding round announced this month, showing that there are still venture backers committed to crypto's potential. While the collapse and bankruptcy of crypto exchange FTX reinforced the need for due diligence and slowed down the pace of funding rounds, it seems like we may start seeing investors get more comfortable in the coming months.

Is crypto winter over? ❄️ We will just have to wait and see where this goes…

Read more here.

⚠️How Silicon Valley Bank’s failure could have spread far and wide

Critics of the US government's rescue of Silicon Valley Bank and Signature Bank last month have accused the Biden administration and the Federal Reserve of bailing out wealthy customers in California and New York while leaving bank customers in Middle America with the bill.

However, a new report by economists from Stanford University, the University of Southern California, Columbia University and Northwestern University, prepared at the request of The New York Times, sheds light on why the banks' failures were deemed a risk to the entire financial system by government officials.

The report analyzed the geographic risks of a banking crisis and found that a run on deposits at those two banks could have triggered a chain of bank failures, impacting small businesses and economic activity across wide parts of the country.

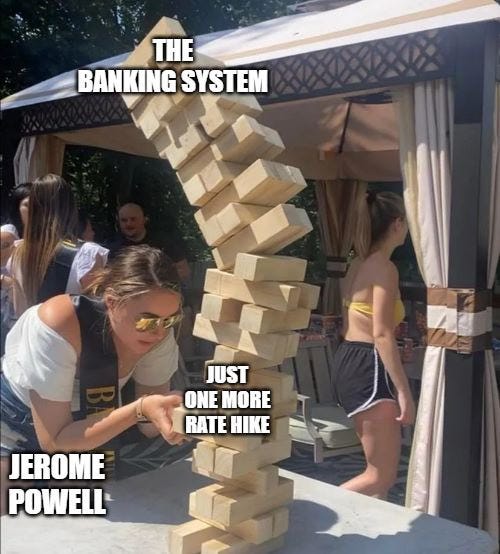

The report highlights the ongoing potential for widespread damage to the entire banking system, which has seen many banks' financial positions deteriorate as the Fed has raised interest rates to combat inflation. The researchers also warned that it has historically been challenging for banks to make significant changes to their financial holdings quickly. While the damage has thus far been contained, the report suggests that larger runs on banks vulnerable to rate increases could result in a significant drop in credit available to store owners, home borrowers, and more. This credit paralysis could have affected almost half the counties in Missouri, Tennessee, and Mississippi, as well as every county in Vermont, Maine, and Hawaii, leading to a credit standstill. Ultimately, in such an event, the costs of the rescue would have been borne by other banks through a special fee imposed by the government.

As the banking industry faces ongoing challenges, its important to be aware of the potential consequences of vulnerable banks and take necessary precautions to prevent further damage. Let’s hope we learnt this lesson well.

Read more here.

📵Montana may show what a TikTok ban could look like for the rest of the country

The state of Montana is further along than any other in the US to pass a bill that would ban TikTok. Introduced in February, the bill has already been approved by the State Senate and is now expected to pass in the State House. The proposed ban would take effect in 2024. Montana’s attorney general, Austin Knudsen, whose office drafted the bill, acknowledged that enacting a state TikTok ban would be difficult. The moves in Montana are part of an intensifying technological cold war between the US and China, with TikTok, which is owned by the Chinese company ByteDance, caught in the middle.

Enacting a ban on TikTok, as proposed in Montana, poses significant challenges. For starters, it is not clear whether the state has the constitutional authority to regulate a national social media app. Even if the bill is signed into law, it is likely to face legal challenges, which would delay its implementation.

In addition, enforcing the ban would be challenging, as TikTok operates on multiple platforms, including Apple and Google app stores, which are widely used by Montanans. Even if these app stores agreed to comply with the ban, it is not technically feasible for them to restrict access to TikTok only in Montana. Users could simply download the app from outside the state.

Furthermore, TikTok has a large and dedicated user base in the United States, and any ban on the app is likely to face backlash from its 150 million users. The company has already mobilized its users in Montana to lobby the state's governor to veto the bill.

Regardless, despite the best efforts of the TikTok (and their 150 million userbase), with federal lawmakers in Washington also pushing for a ban of the app, it seems like TikTok’s fate in this country hangs perilously. Maybe its time for TikTok users to migrate to Instagram reels (or YouTube shorts?) 😉

🚀One week to Startup Connect

TLDR- RSVP to Startup Connect here!

We know you loved StartupConnect II as much as we did. Van Wickle Ventures and Contrary are proud to present StartupConnect Round III this spring!

Looking for a job at a startup? Want to learn from successful founders of venture-backed startups? Come listen to founder lightning talks and meet Brown alumni-founded companies that are hiring on Wednesday, April 19th, from 6–8 PM ET. RSVP to get your invite!

Last year’s event welcomed more than 20 companies and 3 lightning speakers. This year, our event schedule is the following:

6:00–6:15 PM: Introductions

6:15–7:00 PM: Lightning Talks—short, 15-minute chats—with some of Brown’s most celebrated founders:

Tim Newell, COO of Aspiration (6:15–6:30 PM)

Claire Hughes Johnson, Former COO of Stripe and Author of Scaling People (6:30–6:45 PM)

Tom Gardner, Co-Founder and CEO of The Motley Fool (6:45–7:00 PM)

7:00–8:00 PM: Startup Fair where students can drop into breakout rooms for one-on-one chats with up-and-coming founders. Company booths include Formally, Humi, MediCircle, Multitasky, PeduL, Perkies, Poolit, Quiltt, and more.

Learn more about our guests here!

Event hosted on Zoom. Brought to you by Contrary and Van Wickle Ventures. Looking forward to seeing you there! 🚀

🍔What we’re consuming in Venture

This tweet, that reminds us that the “hot” companies of today, would probably not be the top companies in 10 years.

A short explainer on how Udemy solved the “Chicken and Egg”🐔🍳problem

A16Z’s Marketplace 100 for 2023!

That’s it for this week, feel free to email me at zyn_yee_ang@brown.edu with any inquiries!

💡 Follow us!!

Instagram: @vanwickleventures

Twitter: @VanWickleV