🗽The Bulletin #61: Election 2024 - Jobs, Markets, and Money on the Line

A special Election 2024 edition of The Bulletin, where we dive into how financial markets, employment outcomes, and donors are shaping (and being shaped) by the election 🗳️

Hey! I hope you had a fun and spooky Halloweekend 🦇👻

Speaking of scary things… after months of campaigning, chaos, media buzz, and TikTok memes, the 2024 Election is finally upon us. With just one day until Election Day, we’re bringing you a special edition of The Bulletin, diving into how the business world is both shaping—and being shaped by—this election.

Let’s jump straight into it 🤸♀

Market Snapshot: Civil Unrest Fears, Steady Stocks & Shaky Bonds 📈📉

️As Election Day approaches, Wall Street is unusually tense, reflecting deeper anxieties about political stability. Investors, normally focused on portfolios and growth, are now considering risks of civil unrest if the results of the Trump-Harris race are contested. The threat of a prolonged outcome—dragged out by legal challenges—has raised fears of violence and disrupted markets, with intelligence agencies issuing warnings and many investors uneasy about democracy’s resilience under pressure.

Despite the tense climate, the stock market has been remarkably resilient:

↗️ S&P 500 Performance: The S&P 500 has gained 23.3% in 2024, fueled by robust corporate earnings. Historically, stocks tend to power through election cycles, often rewarding those who stay invested through the volatility.

🌄 A Long-Term View: Over the decades, election outcomes have had limited long-term impact on market performance, with steady index fund investments typically outperforming reactive moves based on political swings.

In contrast, the bond market has been far less reassuring, reflecting concerns about rising government debt and potential inflation pressures:

↘️ Bond Market Weakness: The Bloomberg U.S. Aggregate Bond Index saw losses in bond prices this year, with a modest total return of under 2% largely due to interest payments. Over the past decade, annualized returns have only been around 1.5%.

💸 Rising Rates Despite Fed Cuts: While the Fed has recently cut short-term rates, bond market rates have continued to rise. This reflects investor anxiety over the swelling U.S. debt and a possible return to inflation.

😨 Election-Driven Debt Fears: Both presidential candidates’ policies could lead to increased U.S. debt, particularly with Trump’s tax cuts potentially driving budget deficits. If deficits grow, inflationary pressures may build, forcing the Fed to reconsider rate cuts.

🤔So, what’s the best move for investors right now?

Jeff Sommer from The New York Times recommends diversification, especially given the conflicting signals from stocks and bonds. With equities holding strong and bonds signaling caution, safe assets like Treasuries can also provide a buffer.

Regardless, history shows that a steady, long-term approach tends to yield the best results in uncertain times, so avoiding drastic moves until the election dust settles may be the wisest choice. 🦉

(But don’t take our word for it)

Election Jitters & Job Market Uncertainty 🛑📉

With Election Day fast approaching, the job market is feeling the impact of widespread uncertainty. Many businesses have put expansion plans on hold, choosing to wait until the results of the close Trump-Harris race are clear. Here’s an overview:

Hiring on Hold ⏸️: Numerous companies are exercising caution with hiring, focusing on replacement rather than growth roles. The Federal Reserve’s Beige Book reports “subdued” hiring, with 30% of firms surveyed delaying hiring or investments until after the election.

October Slowdown 🌧️🌀: The latest jobs report shows just 12,000 positions added in October, reflecting the effects of recent storms, strikes, and election concerns. The unemployment rate held steady at 4.1%.

Candidates Weigh In on Job Numbers

The weak October jobs report has quickly become a focal point in the election narrative:

Democrats 🫏📈: The Biden Administration has downplayed recent job market sluggishness as temporary, pointing to historically low average unemployment during its term—though this cherry-picked perspective selectively highlights certain metrics. The Democrats also warned that Trump’s proposed tariffs could harm job growth. The White House has pointed to 4% wage growth over the past year as a sign of resilience in the labor market.

Republicans 🐘📉: Trump’s campaign has argued that October’s weak job numbers are indicative of economic mismanagement, particularly affecting blue-collar workers. Republicans have noted the decline in manufacturing employment, which the Bureau of Labor Statistics attributes to strike activity, and argued that the Biden administration has failed to protect key sectors.

With hiring trends subdued and both candidates making their case on the economy, all eyes are on the election’s outcome to assess its potential impact on the job market.🧑🏭

💲The Megadonors Spending $2.5B on the Election

According to a Washington Post analysis of Federal Election Commission data, 50 biggest donors this cycle have collectively donated over $2.5 billion into political committees and other groups competing in the election.

These Megadonors are mostly Republican, though there are donors that are affiliated with the Democrats and third-parties as well.

Most of the funds from top donors have flowed into super PACs, which can receive unlimited contributions from individuals and frequently collaborate with campaigns, even though regulations prohibit them from coordinating their advertisements.

🕴️Top Individual Donors

The top 7 individual donors for this election cycle are all Republican. Taking the number 1 spot is Timothy Mellon, grandson of banking tycoon Andrew Mellon, who has donated $197M to MAGA inc, American Values 2024, and the Congressional Leadership Fund.

💰Top Individual Republican Donors

Timothy Mellon - $197M

Richard & Elizabeth Uihlein - $139M

Miriam Adelson - $136M

Elon Musk - $132.2M

Kenneth Griffin - $103.7M

Jeff & Janine Yass - $96.2M

Paul Singer - $63.4M

💵Top Individual Democrat Donors

Michael Bloomberg - $47.4M

Dustin Moskovitz - $38.9M

Reid Hoffman & Michelle Yee - $34.8M

Fred Eychaner - $32.7M

James & Marilyn Simons - $30.7M

Stephen Mandel - $30M

Deborah Simon - $19.6M

👩💼Top Organization Donors

Top organizational donors are also pouring billions into the 2024 election to influence key races on both sides of the political aisle.

🫏Democratic groups like Future Forward USA Action ($138.5M) and Majority Forward ($113.2M) are backing Harris and Senate races, while 🐘Republican-aligned Empower Parents PAC and One Nation have funneled $82.5M and $53.6M into GOP campaigns. 💜Bipartisan donors, including Coinbase ($93.6M) and Ripple Labs ($51M), are supporting pro-crypto initiatives across both parties, collectively shaping key races with massive financial support.🪙

Political campaigns are costly endeavors, requiring significant funds for ads, staff, and outreach. The 2020 election saw record-breaking spending of $14 billion, underscoring the role of Super PACs, which can raise unlimited funds independently. While money is crucial for visibility, it doesn’t guarantee a win. Remember to vote!🏆

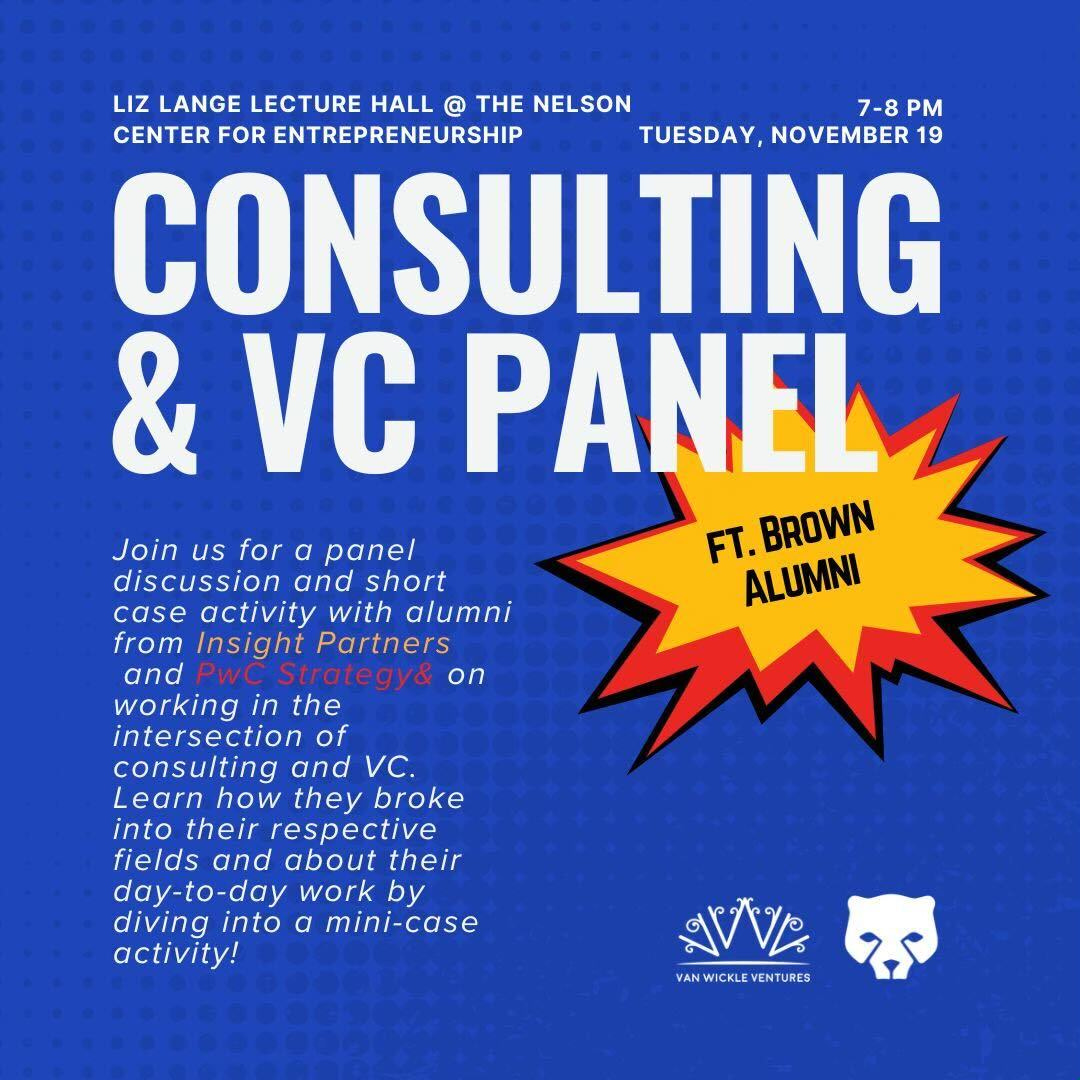

🔥Opportunity: VWV x BCC Consulting and VC Panel

Join us for a Consulting and Venture Capital Panel, hosted by Van Wickle Ventures (VWV) and the Brown Consulting Club (BCC)! 🐻 Hear insights from Brown alumni currently at Insight Partners and PwC Strategy&, and participate in a mini case activity to apply what you learn!

📅 Date: Tuesday, November 19

🕖 Time: 7:00 - 8:00 PM

🏫 Location: Liz Lange Hall in the Nelson Center for Entrepreneurship

Don't miss this opportunity to connect with industry experts and gain hands-on experience in consulting and venture capital! 🚀

That’s it for this week, feel free to email me at zyn_yee_ang@brown.edu with any inquiries! Take care of yourselves 💖

Follow us:

Instagram: @vanwickleventures

Twitter: @VanWickleV