💳 The Bulletin #75: A Big VWV Announcement, Nvidia's Manufacturing Plan For Supercomputers, Capital One's Merger with Discover for $35B, and Kodiak to Go Public in a $2.5B SPAC Deal

In this week's bulletin - Kodiak plans to go public, Trump claims "victory" following Nvidia's announcement to make AI supercomputers entirely in the U.S., and Capital One will merge with Discover! 🦦

Welcome back to the weekly VWV Bulletin! 😁 Hang in there, less than a month left! 🥳

📌 For this semester, keep up with our content if you’re interested in:

Demystifying & breaking into VC

Finding opportunities in the start-up world

Keeping up with VC investment news at Brown & beyond (pro tip: this is essential to breaking in and finding opportunities)

Enjoy the Bulletin!😇

🎉 A Big VWV Update

Van Wickle Ventures is pleased to announce the addition of two new Investment Committee members: Khalil Fuller ‘14 and Olivia Tulkoff ‘22!

Khalil Fuller is a partner and Head of Dorm at Pear VC. Khalil graduated from Brown University with an independent concentration in Social Innovation and Education and earned a joint MBA/MA from Stanford as a Knight-Hennessey Scholar. Khalil is a serial entrepreneur, with his companies having cumulatively reached $100M in revenue and more than 5M users. He has founded startups such as Learn Fresh, an EdTech company looking to make math fun by integrating sports and entertainment; Trak Changes, a software platform for construction contractors; and Gift Card Bank, a nonprofit that looked to help low-income families in need during the pandemic. At Pear, Khalil is a leader in backing student entrepreneurs.

Olivia Tulkoff is an investor at Lead Edge Capital, a leading growth equity firm in New York. Olivia graduated with a degree in Public Policy and is a proud VWV alumnus and former co-director! Following graduation, Olivia joined Goldman Sachs as an Investment Banker in the Real Estate group before moving to the investing world. At Lead Edge, she specializes in investing in software, internet, and tech-enabled services companies.

We warmly welcome Olivia and Khalil to the VWV family!

🎙️ Opportunity: Startup Connect IV with Former Index Ventures Partner Mark Goldberg

Join Van Wickle Ventures and Contrary for StartupConnect IV: In Conversation with Mark Goldberg, a candid fireside chat with one of venture’s most thoughtful voices. Mark Goldberg, Founder and Managing Partner at Chemistry Ventures, former General Partner at Index Ventures, and investor in top companies like Plaid and Persona, will share his journey from operator to VC, what he looks for in founders, and where he sees opportunities in today’s market.

Whether you’re a founder, aspiring investor, or just curious about how top VCs think—this is a rare chance to hear directly from someone shaping the future of tech!

Sign up here: https://lu.ma/w5nhld73

🧈 Nvidia’s Supercomputers Amid Tariffs

Shortly after Trump announced new tariffs on semiconductor imports, Nvidia revealed plans to invest up to $500 billion in AI infrastructure in the United States. For the first time, the semiconductor company will manufacture its AI supercomputers entirely in the United States. Nvidia has secured over 1+ million square feet of manufacturing space for building and testing its products. It plans to produce its Blackwell chips in Arizona and AI supercomputers in Texas.

This decision follows TSMC and AMD’s similar moves amidst tariffs. TSMC had announced in early March that it would reach an expected $165 billion in U.S. manufacturing operations. AMD recently announced it will manufacture its chips at TSMC’s planned plant.

Less than a day after Nvidia’s manufacturing announcement, Trump claimed “victory” over the company, indicating the move was due to his imposed tariffs.

As demand for advanced chips and AI computing infrastructure accelerates, it will be interesting to see in the months and years ahead how tariff policies continue to shape the strategies and supply chains of semiconductor companies.

💰 Capital One Bank Acquires Discover for $35B

On Friday last week, key banking regulators approved a merger between Capital One and Discover, two of the largest credit card companies! The all-stock deal was announced in February of 2024 and is expected to close next month on May 18.

Capital One’s credit card users are on networks run by Visa and Mastercard. A merger with Discover will provide it with immediate access to a credit card network of 305 million cardholders, more than 3 times its current customer base. Capital One will also acquire Discover Bank and become the U.S.’s largest credit card company. In a month, the merger will become a greater challenge to all competitors.

As part of the agreement, Discover shareholders will receive 1.0192 Capital One shares for each Discover share, roughly about a 26% premium based on Discover’s closing price of $110.49. Capital One has also agreed to pay Discover’s $100 million in fines to affected customers for overcharging interchange fees, an action against Discover by the Fed.

📣 Kodiak to Go Public in a $2.5B SPAC Deal

After weeks of global trade wars, many companies have halted their plans for an IPO. Despite tariff challenges, Kodiak has announced that it will merge with a blank-check company to go public, valuing the startup at about $2.5 billion!

Kodiak Robotics is one of the leading players in the push to automate long-haul freight transportation. Going public in a difficult market signals that investors still believe in the future of self-driving vehicles as a solution to driver shortages, high operating costs, and supply chain inefficiencies.

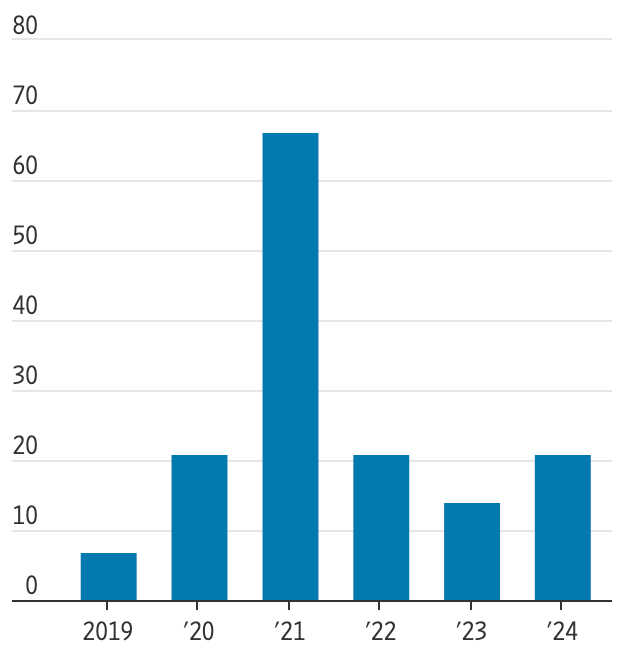

Here is a graph of the number of mobility-tech VC exits from IPO from the WSJ!

The deal is expected to close in 2025. To make the agreement work, investors such as Soros Fund Management, ARK Investment Management, and Ares Management have invested $110+ million to support the deal, along with $550+ million of cash held in trust.

🆙 We’re Updating Our Website

We love our website, and want to make sure it is accurate and up-to-date. Please let us know through this form if you are a part of the VWV team (Investment Committee, Advisors, Alumni) and have changes you wish to make to your personal profile.

That’s it for this week, feel free to email me at eason_zhang@brown.edu with any thoughts or inquiries! 💌

Follow us:

Instagram: @vanwickleventures

Twitter: @VanWickleV