VWV Volumes #23: Analyst-in-Training Imani Stewart Discusses 3 VC Firms that are Betting on Crypto

Cryptocurrency and blockchain startups are the next big thing in the world of venture capital. From non-fungible token (NFT) companies like Brown alum-founded OpenSea, to startups focusing on Web3 - which can be understood as an effort to decentralize applications by running them on the blockchain and/or a network of nodes to alleviate issues found in current internet usage like data breaches, data tracking, and governmental censorship - startups utilizing the technological advantages of blockchain are here to stay.

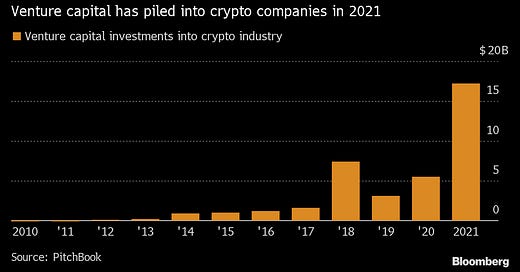

In 2021, venture capital firms invested a record $33 billion into the crypto sector, more than all prior years combined. Here are three VC firms that are focusing primarily or solely on investing in the crypto sector.

Paradigm

Paradigm is a “crypto-native” venture capital firm focused exclusively on investing in crypto companies. Paradigm was founded in 2018 by Coinbase co-founder Fred Ehrsam and former Sequoia Capital partner Matt Huang, and in November 2021 announced it closed the largest venture fund the crypto world has seen at a whopping $2.5Bn.

Paradigm has previously invested in companies including their co-founder’s own crypto exchange Coinbase, FTX, a cryptocurrency derivatives exchange that recently launched a venture fund of their own, and Uniswap, an Ethereum-based decentralized exchange (DEX) for trading tokens hosted on the Ethereum network.

According to their website, Paradigm is primarily interested in early-stage investments, and has a team of about 30 employees.

Andreessen Horowitz (a16z)

Paradigm’s chief VC competitor is Andreessen Horowitz (a16z), which has a crypto-native subsidiary named a16z Crypto. This smaller arm of the company has a 40-person team and recently closed their third and largest fund of $2.2Bn dollars. This fund will be invested in companies from early seed-stage to fully developed companies seeking later-stage funding.

a16z was founded in 2009 by Marc Andreessen and Ben Horowitz and has been investing in cryptocurrency companies since 2013, with their first and second funds accumulating $300 million and $515 million in respective LP commitments. a16z provides support to the companies in their portfolio in part by assisting them in the design of protocols and mechanisms, navigating the current crypto landscape, as well as actively participating in the company’s governance.

Notable companies which have been funded by a16z crypto include Uniswap, where a16z led the Series A round, Dapper Labs, which is known for creating sports moment NFT platform NBA Top Shot and received a $7.5Bn valuation in April of 2021, and Dfinity, a blockchain infrastructure startup, which received a $9.5Bn valuation in September 2020.

FTX Ventures

A fresh new player in the crypto VC world is FTX Ventures. Announced this year, FTX Ventures is headed by Amy Wu, who departed from Lightspeed Venture Partners to oversee this new team of eight. FTX Ventures’ $2Bn fund will invest in Web3 projects focusing on gaming, fintech, and other sectors.

At Lightspeed, Wu led the investment into parent company FTX in 2021. FTX was co-founded in 2019 by MIT alums Sam Bankman-Fried and Gary Wang, and is headquartered in the Bahamas. Notable contracts from FTX include sponsorships with Major League Baseball, a partnership with Tom Brady and Gisele Bundchen, and naming rights for the arena the Miami Heat calls home.

Closing Thoughts

These are just a few crypto venture firms to give an introductory glance into the market, which now exceeds 500, as non-crypto-native firms join the ranks. Furthermore, the fundraising rounds are happening fast in this exploding new industry, with 62% of managers who raised funds in 2020 raising funds again in 2021. As the crypto startup ecosystem matures and their 2021 Q4 median pre-money valuations hit $70 million – 141% higher than the median across all sectors in the same quarter – it’s not surprising that venture capital firms are more interested than ever in this new digital landscape.

Sources

https://techcrunch.com/2021/11/15/crypto-vc-firm-paradigm-debuts-monster-2-5-billion-fund/

https://a16z.com/2021/06/24/crypto-fund-iii/

https://www.galaxydigital.io/post/2021-crypto-vcs-biggest-year-ever/