VWV Volumes #5: New Associate Ria Panjwani '23 talks about a new investment vehicle, SPACs

SPACs: A Spectacular Rise to Prominence

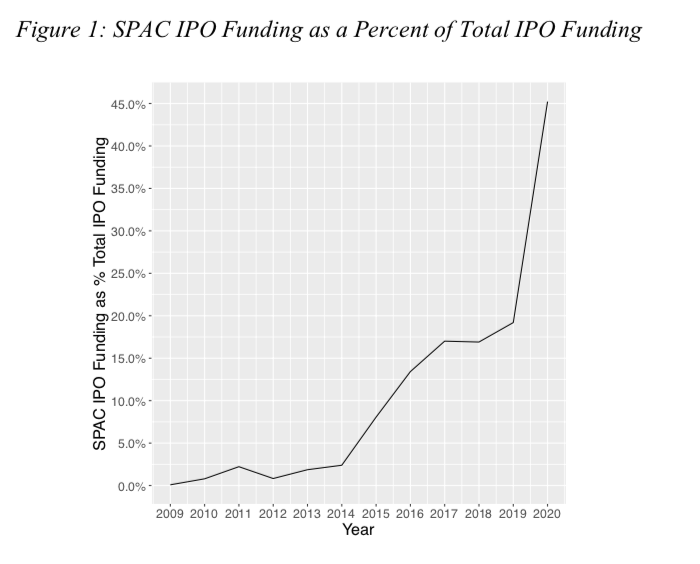

Special Purpose Acquisition Companies(SPACs) are publicly traded blank shell companies created to pursue deals. SPACs - also known as blank check companies - have been all the rage in 2020, as 71 deals have been announced with target companies and almost half of the fundraising in the IPO market was for SPACs, more than six times the amount raised in 2019. The dramatic growth of SPACs in the wake of the COVID pandemic offers companies an easier way to go public, as the process essentially flips the traditional IPO on its head. In a year marked by volatility, SPACs offer less uncertainty, speed, and control for companies wanting to go public.

How SPACs Work

In an IPO, a company announces its desire to go public, discloses financial and business operations, investors pour money in, and have to wait 24 - 36 months before the company goes public. SPACs allow investors to pool their money first with no idea of what they’re investing in, goes public as a shell company, and then makes a deal within two years of going public with a company that wants to IPO, drastically increasing the speed of the process (3 - 4 months) as disclosures don’t have business operations to describe. Investors now own stock in a real company, and if they don’t like the company chosen, they can leave the deal with their money back.

Resurgence of SPACs: A quick history, and a rise to prominence

Today’s SPACs are remnants of “blank-check corporations” from the 1980s which were known for scamming people and investing in smaller companies, not quite ready to go public, promising lofty expectations.This produced a record of poor results: of 107 that have gone public since 2015 and executed deals, the average return on their common stock has been a loss of 1.4%, according to Renaissance Capital, a research and investment-management firm- which has damaged SPACs reputation and prevented growth. Federal regulation allowed for changes in the structure of SPACs to create a more sustainable and reliable way of investing, attracting well-known names is business, leading to more public trust. To protect investors, regulations allow investors to redeem their shares, collecting it’s IPO price (usually $10 a share and interest) before a deal. Additionally, many SPACs reward their sponsors with something called the sponsor promote - a deal by allowing them to buy 20% of the company for just $25,000.

According to the Wall Street Journal, in 2009, after a fall-off during the financial crisis, there was a single $36 mn SPAC IPO. In 2019, 59 SPAC IPOs raised $13.6 bn. In 2020, SPACs raised as much cash in their IPOs as they did over the entire preceding decade, a record $82.1 billion in 2020 as of Dec. 24 — a sixfold increase from last year's record high.

Source: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3720919

Many of the market conditions created by COVID created a resurgence of interest in SPACs as getting an IPO done looked uncertain as markets started to tumble. A typical IPO- learning about the amount of capital raised after months of discussion, uncertainty of a fall through - seemed like too daunting a process to imagine during 2020, allowing SPACs to flourish.

Upsides of SPACs

Downsides of SPACs

Critics - calling SPACs an inadvertent loophole - worry SPACs don’t go through the same level of scrutiny as traditional IPOs, creating substantial costs, and promoting unsustainable claims, and point out that a few SPACs sponsored by high-profile funds have performed well, but they are exceptions, not the rule. According to “A Sober Look at SPACs,” although SPACs raise $10 per share from investors in their IPOs, by the time the median SPAC merges with a target, it holds just $6.67 in cash for each outstanding share. This drop is mostly due to dilution of SPAC shares as sponsors are given 20% of the acquired company as compensation for creating a merger with the target company. Therefore, while sponsors benefit, the dilution is a cost to other shareholders. In terms of unsustainable claims, SPACs are freely allowed to provide projections and forward-looking statements to potential investors, without the same level of scrutiny. Although the IPO process is arduous and lengthy, it was designed to provide transparency, while SPACs rely on branding of the SPACs sponsors rather than the deal itself.

Additionally, in a year of record unemployment, more and more people have become self-proclaimed day traders, providing their insights on the market, with a firm belief that they have figured it out. As an avid Tik Tok user, I fell into a place called “StockTok,” where many people produced 60 second clips every hour of stocks to watch, when to sell, and when to buy, saying “trust me, look at how much money I’ve made!” TD Ameritrade reports that visits to its website giving instructions on trading stocks have nearly quadrupled since January. Meanwhile, trading apps like Robinhood are seeing a surge in business, with 4.3 million daily average revenue trades, more than established brokerage firms.

Financial experts are worried about the insert of SPACs into this space, as more and more people invest based on familiar faces they see leading the deal: former NBA basketball legend Shaquille O’Neal, along with three former Disney executives and one of Martin Luther King Jr.’s sons, are planning to launch a SPAC that targets technology and media companies, or U.S. House of Representatives Speaker Paul Ryan, and Oakland Athletics executive Billy Beane, who was featured in the film and book Moneyball who are both starting SPACs. Financial experts identify this to be troubling, as individual investors are entering a space they do not know much about, and to many, this is reminiscent of the dot-com crash in the late 1990s.

Final Thoughts

If anything, 2020 has shown just how quickly things can change. I believe SPACs are here to stay: flexibility for investors and companies wanting to go public is promising as the traditional IPO process is limiting in many ways, however additional regulations promoting transparency and the alignment of shareholder and sponsor incentives are necessary to ensure their success.

Thanks for reading VWV Volumes, our dose of providing you insight into the broader VC, startup, and tech ecosystem. Love what we’re doing, working on your own startup, or just want to chat? Feel free to email us at vwv@brown.edu